Age: Younger drivers pay more for car insurance coverage because they're most likely to enter an accident. Insurance coverage rates decrease as you build a safe driving history, but this can take years. Rates may also begin to increase when you reach age 65 and older as the risk of being hurt or eliminated in an auto accident increases.

Factors Your Car Insurance Rates Could Increase The Insurance coverage Services Workplace reports a typical boost of 20 - 40% of the state's base rate after an accident. The state's base rate is the typical rate before any discount rates are used. If you have a one-car policy, your rate will increase 40%.

The Greatest Guide To Average Car Insurance Cost By Category In 2021 - Wallethub

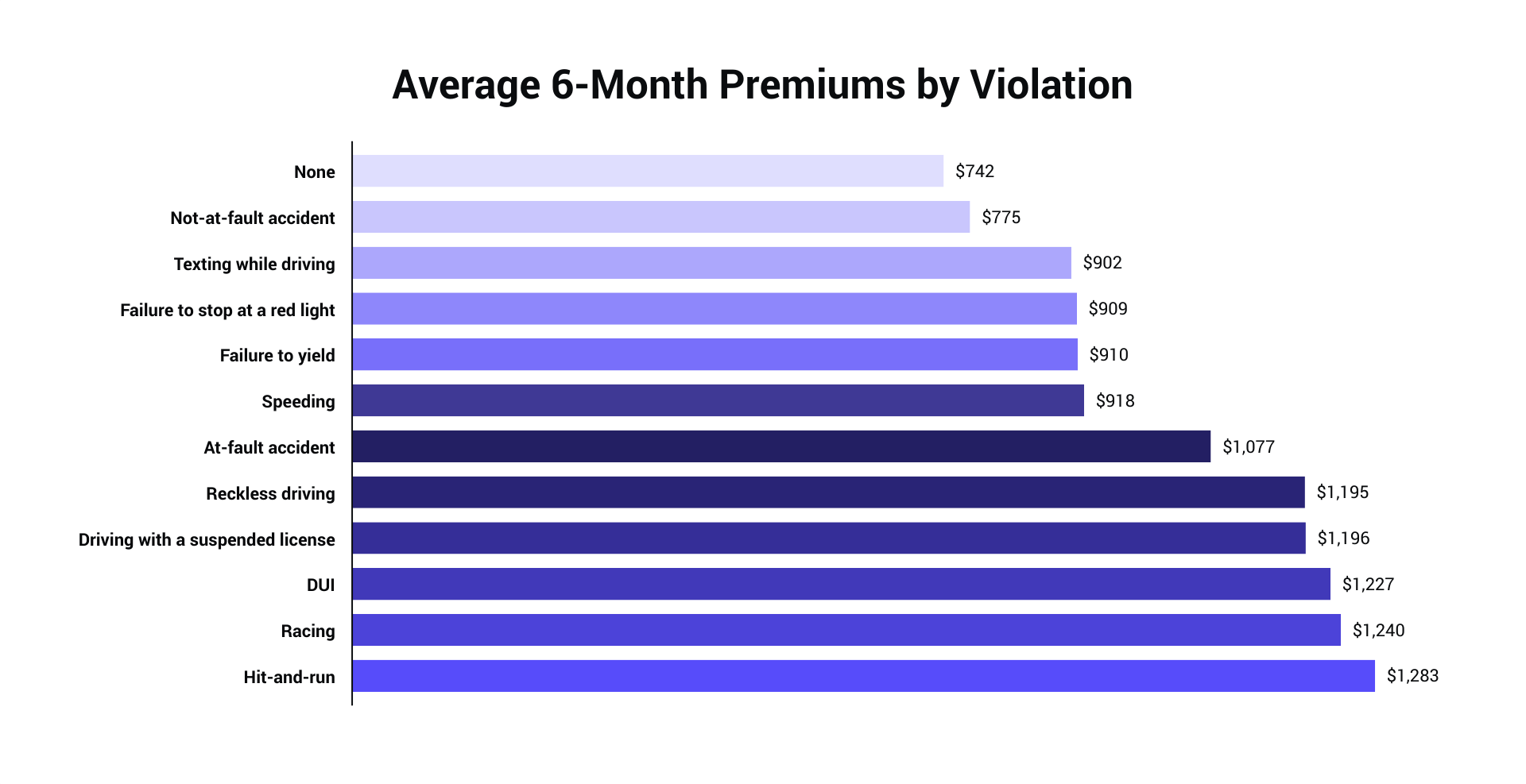

If there's any reward to follow the law and prevent speeding, it might be the 22% boost your premiums can experience with just one ticket. This is simply the average. The actual increase depends on the infraction and where you live. It's not unusual to see over a 100% boost in your premium.

Texting while driving may impact your rates click here in some states, depending upon if your state considers it a moving offense. Simple infractions, such as a small speeding ticket, might just affect your rates for 3 years. However, major violations, such as a DUI, could impact your rates as long as ten years.

Some Of Three Residents Indicted For Insurance Fraud By Grand Jury

The most common is bundling house owners insurance and cars and truck insurance, with an average cost savings of $295 per year. The largest cost savings are generally seen in Georgia and Oklahoma, both of which use an average 22% savings for bundled insurance policies.

Looking For Auto Insurance The average American stays with the same provider for 12 years. About 14% of Americans use the same carrier for 20 - thirty years. Just about 16% of drivers inspect to see if they are qualified for any brand-new discount rates on their car insurance coverage. A couple of essential occasions that may qualify you for lower rates include: Marriage, Operating in some industries such as health and education, Paying renewal premiums early, Short daily commutes (less than 5,000 miles annually), particularly for usage-based insurers such as Metromile.

7 Simple Techniques For How Much Does Car Insurance Cost On Average? - The Zebra

These discounts are not automatic. The chauffeur needs to notify an agent of their eligibility to get the discount. More than 50% of Americans say they simply don't have the time to look around for insurance coverage quotes. Simply over 40% also think the process is too made complex. Teen Drivers and Automobile Insurance coverage Adding a female teen driver to your insurance policy instead of a male teen generally leads to a lower premium increase.

The death rate for motor car accidents for males is double that of women. This contributes to the lower premium increase for women. Teenage young boys increase the average insurance coverage expense by as much as 176%. This is almost 50% higher than the premium increases for a teenage girl. Young drivers do not have much of a driving history.

The Best Strategy To Use For How Pay-per-mile Auto Insurance Works – Forbes Advisor

You might be paying hundreds of dollars more each month without understanding it. Note: This site is made possible through financial relationships with some of the products and services pointed out on this website.

If you have an interest in discovering an insurance representative in your area, click the "Agent, Finder" link at any time to go to that search tool. If you are interested in finding an agent that represents a specific business, you can likewise click on the business name in the premium contrast which will link you to that company's site.

You Really Can Lower Your Car Insurance Cost - The New ... Can Be Fun For Everyone

The average expense of car insurance in the United States is $2,388 per year or $199 monthly, according to information from nearly 100,000 insurance policy holders from Savvy. The state you reside in, the level of protection you want to have, and your gender, age, credit rating, and driving history will all factor into your premium.

Insurance coverage is managed at the state level, and laws on needed coverage and pricing are different in every state. Insurance business take into account lots of various elements, including the state and location where you live, as well as your gender, age, driving history, and the level of coverage you 'd like to have.

The Buzz on Auto Loans & Financing - Navy Federal Credit Union

Here are the greatest aspects that will influence the cost you'll pay for coverage, and what to consider when looking at your cars and truck insurance coverage alternatives. There have been some huge modifications to cars and truck insurance coverage expenses during the coronavirus pandemic.

Business Expert created a list of typical vehicle insurance prices for each state. These rates were determined as an average of rates reported by Nerdwallet, The Zebra, Worth, Penguin, Bankrate, and the National Association of Insurance Commissioners. Here's a range cars and truck insurance coverage costs by state. Source: Data from Nerdwallet, Worth, Penguin, Bankrate, The Zebra, and the National Association of Insurance Commissioners.

Everything about New Cars, Used Cars For Sale, Car Reviews And Car News

And from Organization Expert's information, automobile insurance coverage business tend to charge ladies more. Organization Insider collected quotes from Allstate and State Farm for fundamental protection for male and female drivers with a similar profile in Austin, Texas. When swapping out only the gender, the male profile was estimated $1,069 for protection per year, while the female profile was quoted $1,124 each year for protection, costing the female driver 5% more.

In states where X is a gender alternative on driver's licenses including Oregon, California, Maine, and soon New York insurers are still identifying how to determine expenses. Average vehicle insurance coverage premiums by age, The variety of years you've been driving will affect the cost you'll pay for coverage. While an 18-year-old's insurance coverage averages $2,667.

15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia for Beginners

This information was provided to Organization Expert by Savvy. How vehicle insurance rates alter with the number of automobiles you own, In some ways, it's sensible: the more cars and trucks you have on your policy, the higher your cars and truck insurance coverage bills. There are likewise some savings when numerous automobiles are on one policy.

Cars and truck insurance is less expensive in postal code that are more rural, and the very same is true at the state level. Guarantee. com information reveals that Iowa, Idaho, Wisconsin, and Maine have the most affordable cars and truck insurance coverage of all states, which's since they're more rural states. Other aspects that can affect the cost of cars and truck insurance coverage There are a few other factors that will contribute to your premium, consisting of: If you don't drive numerous miles each year, you're less likely to be included in a mishap.

The Best Strategy To Use For Here's Exactly How Much To Save Each Month For ... - Missoulian

Each insurer takes a look at all of these aspects and costs your coverage differently as an outcome. It's important to compare what you're used. Get quotes from numerous various car insurer and compare them to ensure you're getting the very best offer for you. Personal Finance Reporter.